How to apply for financing with Slope

Before getting started with your Slope application, we recommend having the following information available:

Business information: legal name, tax ID, address, website, phone number, email

Annual revenue over the last 12 months

Name, date of birth, SSN, home address, email, and phone number for each individual owning 25% or more of the business, plus one senior business leader (e.g., CEO, CFO, President) - required by regulation

Authorization from one such owner or leader for a consumer credit soft pull - this will not impact credit scores

Be prepared to connect all business bank accounts with Plaid - this helps us prevent fraud and issue approvals in seconds

The application process takes about 5 minutes from start to finish. At the end of it, you may be automatically approved for up to $250K, or we may request additional information before a credit decision is made. we will also guide you on next steps, if you're interested in and potentially eligible for more than $250K in financing.

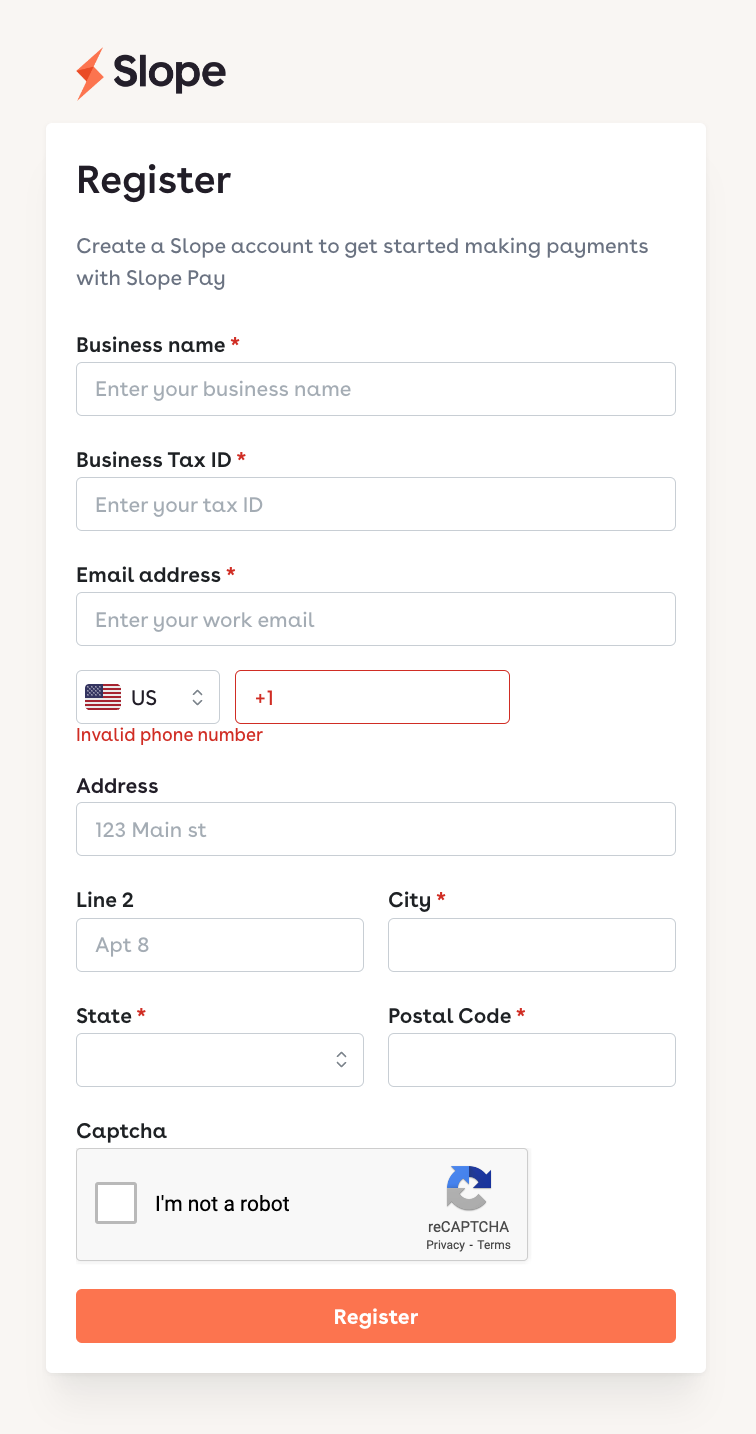

Once you have all the info you need, click the referral link provided to create an account at pay.slopepay.com. You'll need the following information first: Business name, tax ID, email, phone number, business address.

After clicking "Register", you'll be directed to verify the email account and set up a password. Once you log in for the first time, you'll be directed straight into our financing application.

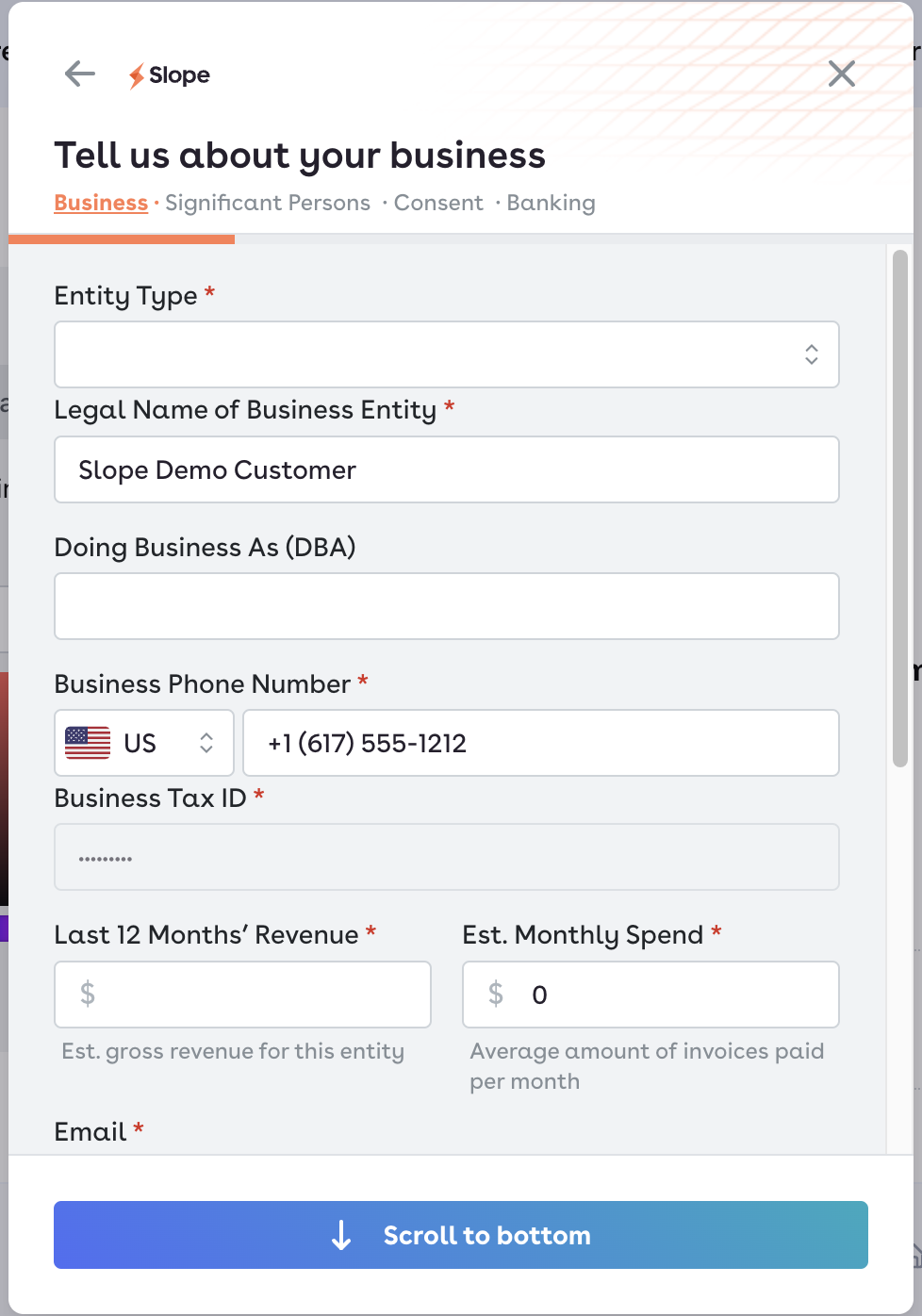

You'll start by entering the following business information: business name, estimated revenue and monthly spend, physical address, website, phone number, email.

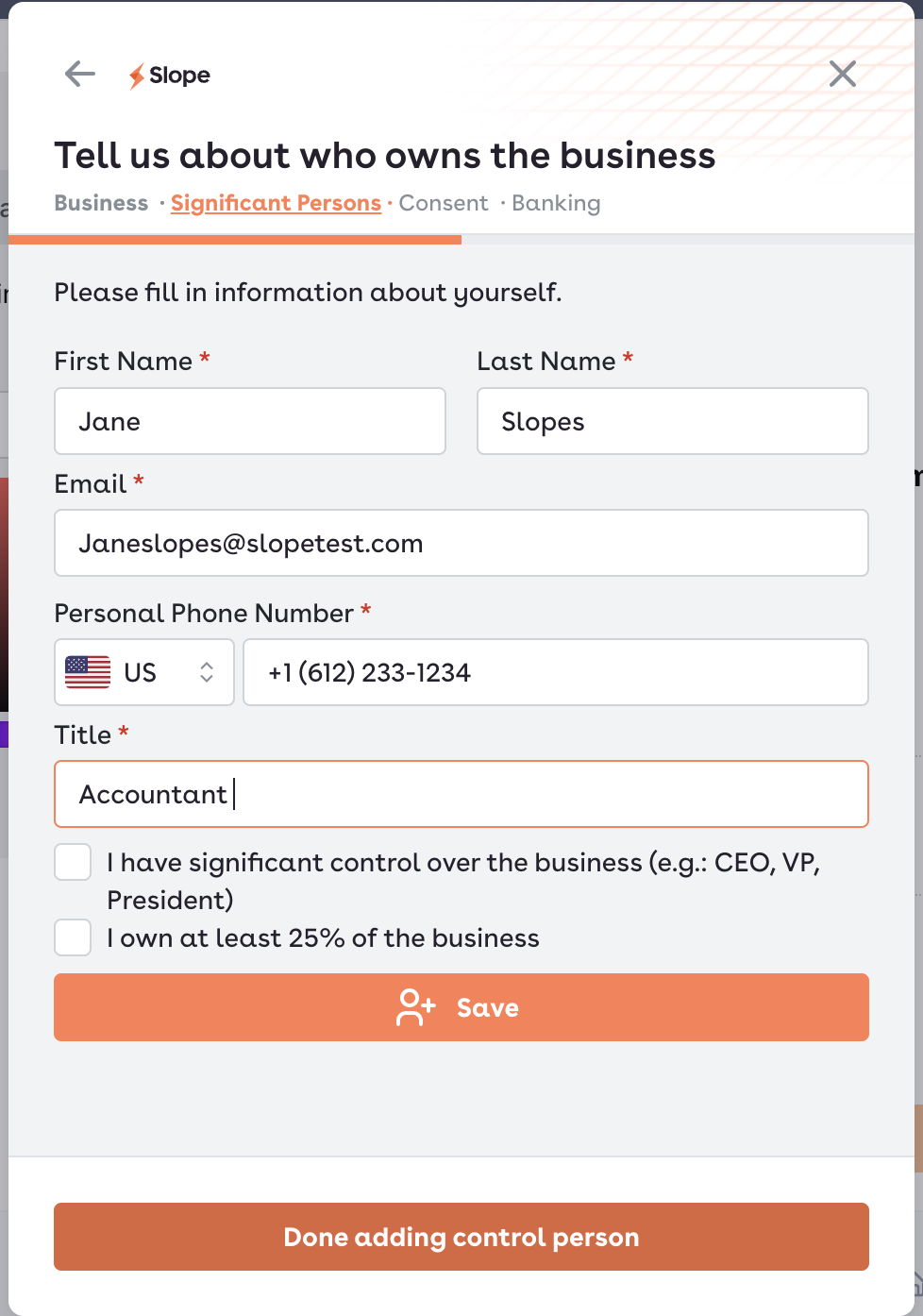

We'll then ask you, the applicant, to provide your details, so we can be in touch if we have any questions. If you have significant control over the business and/or own at least 25% of the business, please check the respective boxes.

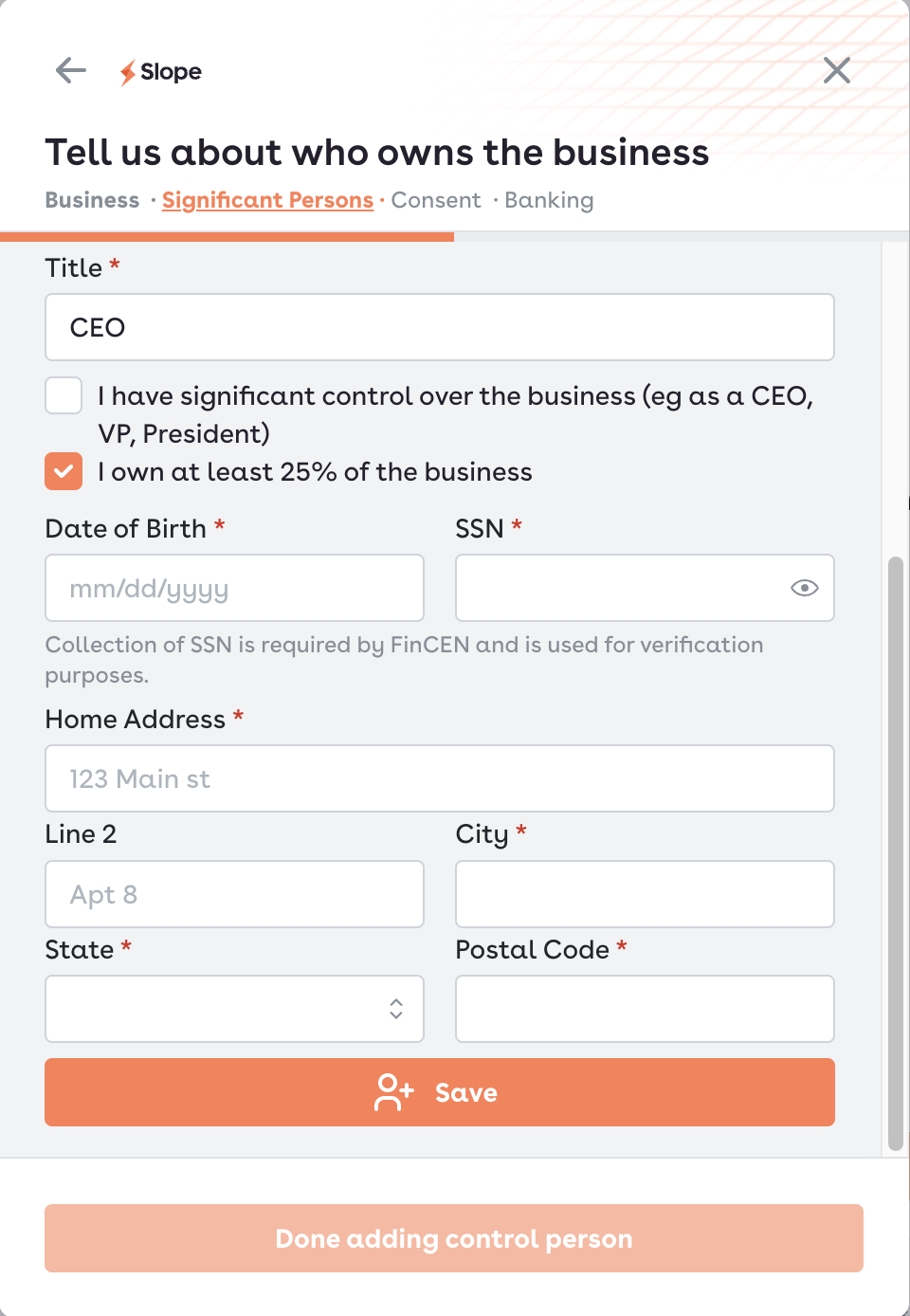

If you are a beneficial owner of the company, you will need to provide the following: name, DOB, SSN, and personal address.

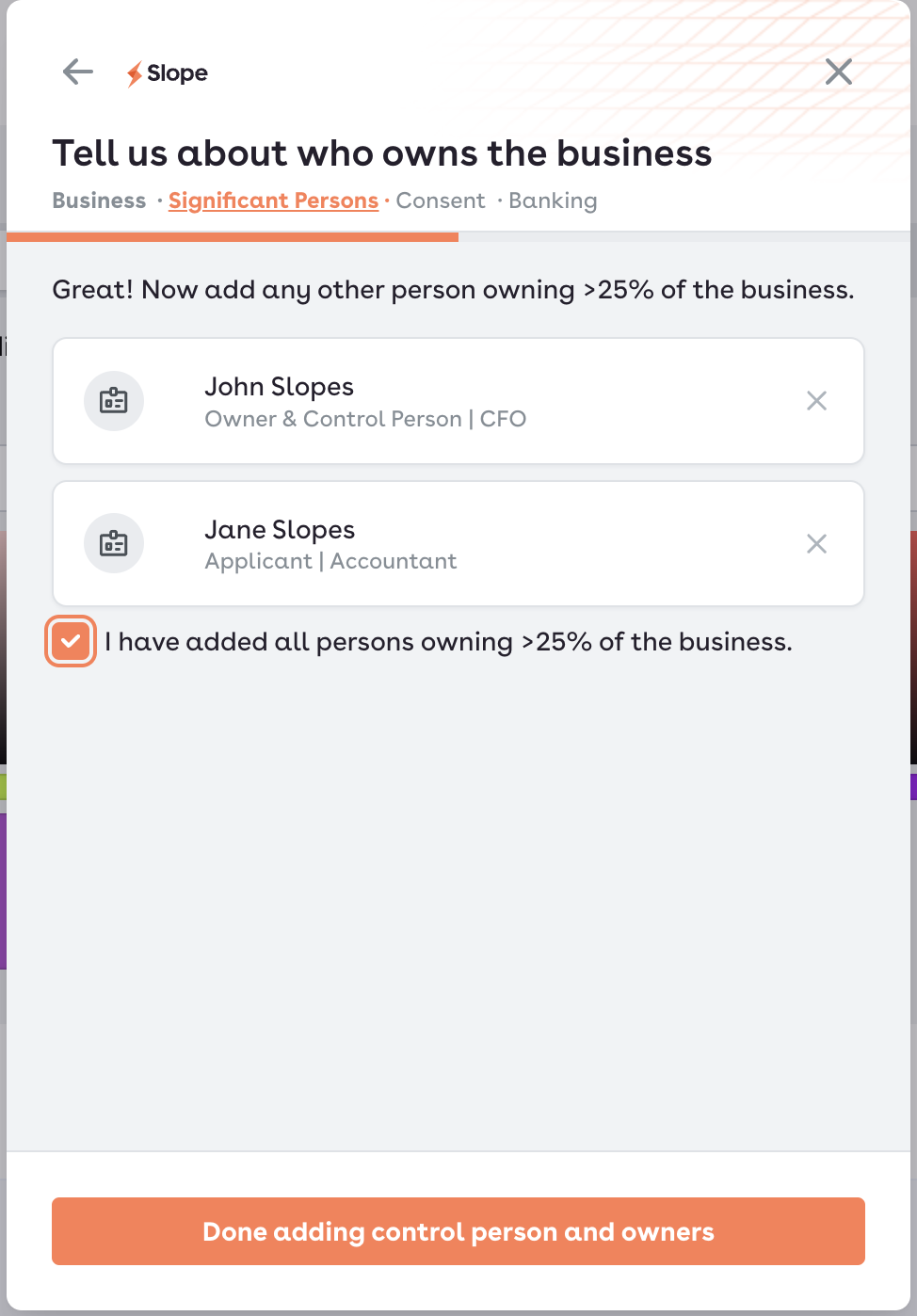

Once you've added all significant person related to the business, you will see the following screen:

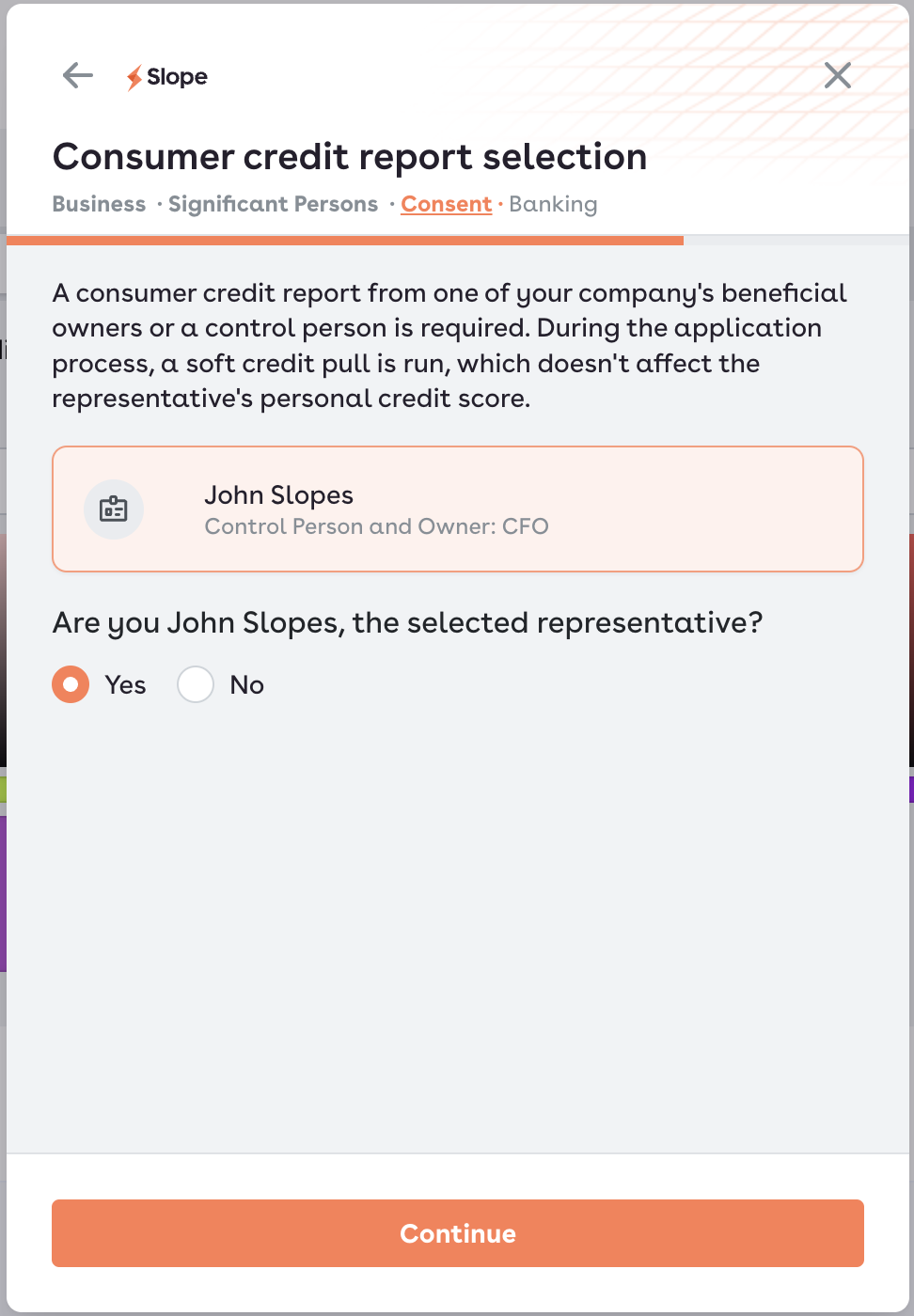

Select a beneficial owner or control person that you'd like to authorize a soft pull on their consumer credit. This doesn't impact the individual's personal credit score.

If you're not the individual authorizing the consumer credit pull, select No. We will email the individual asking for their permission.

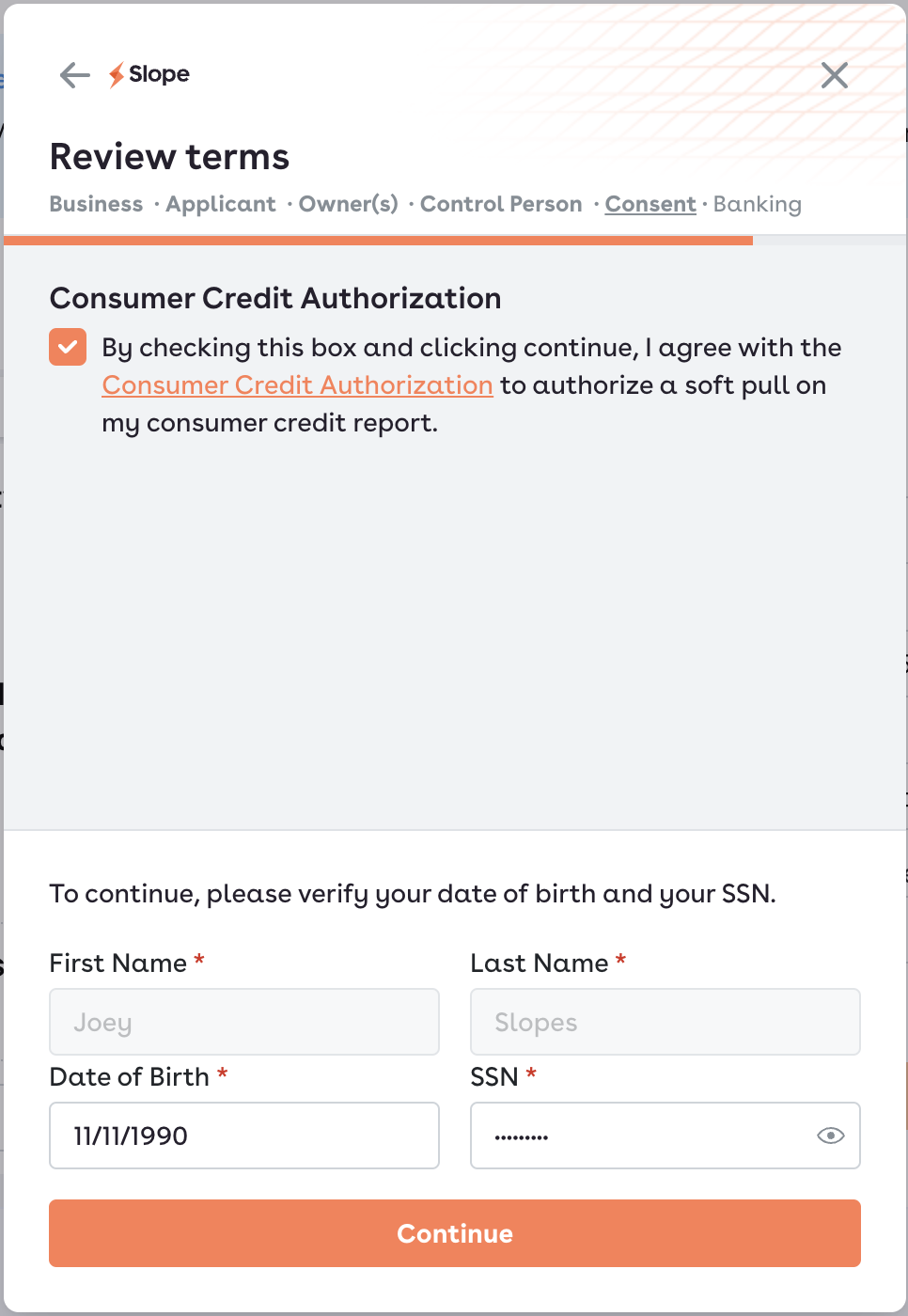

If you are the individual authorizing the pull, enter in your DOB and SSN.

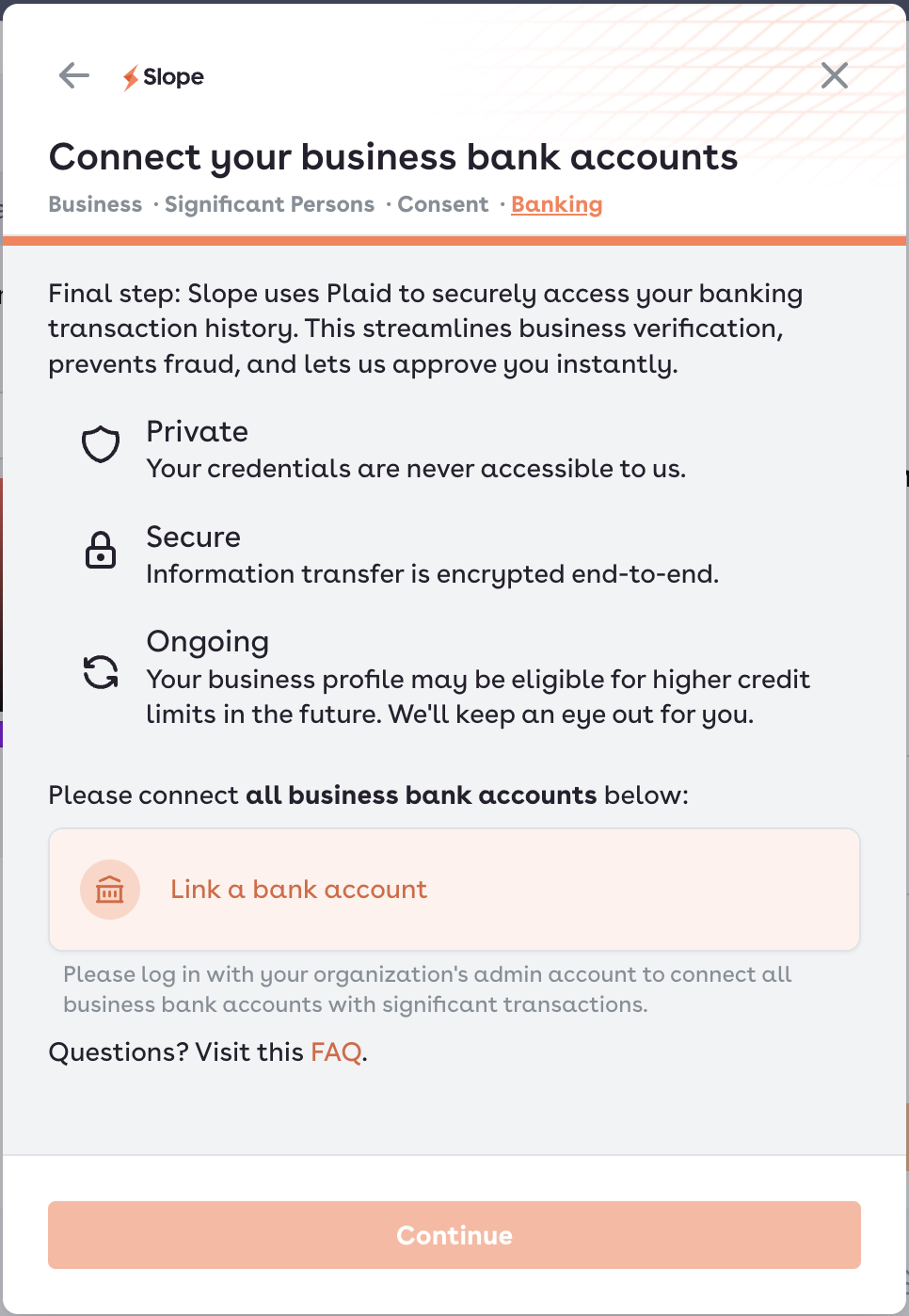

You will then be directed to connect your bank accounts via Plaid.

Please connect all your business bank accounts with meaningful transactions. This is key for us to give your the appropriate limit, according to your business revenue.

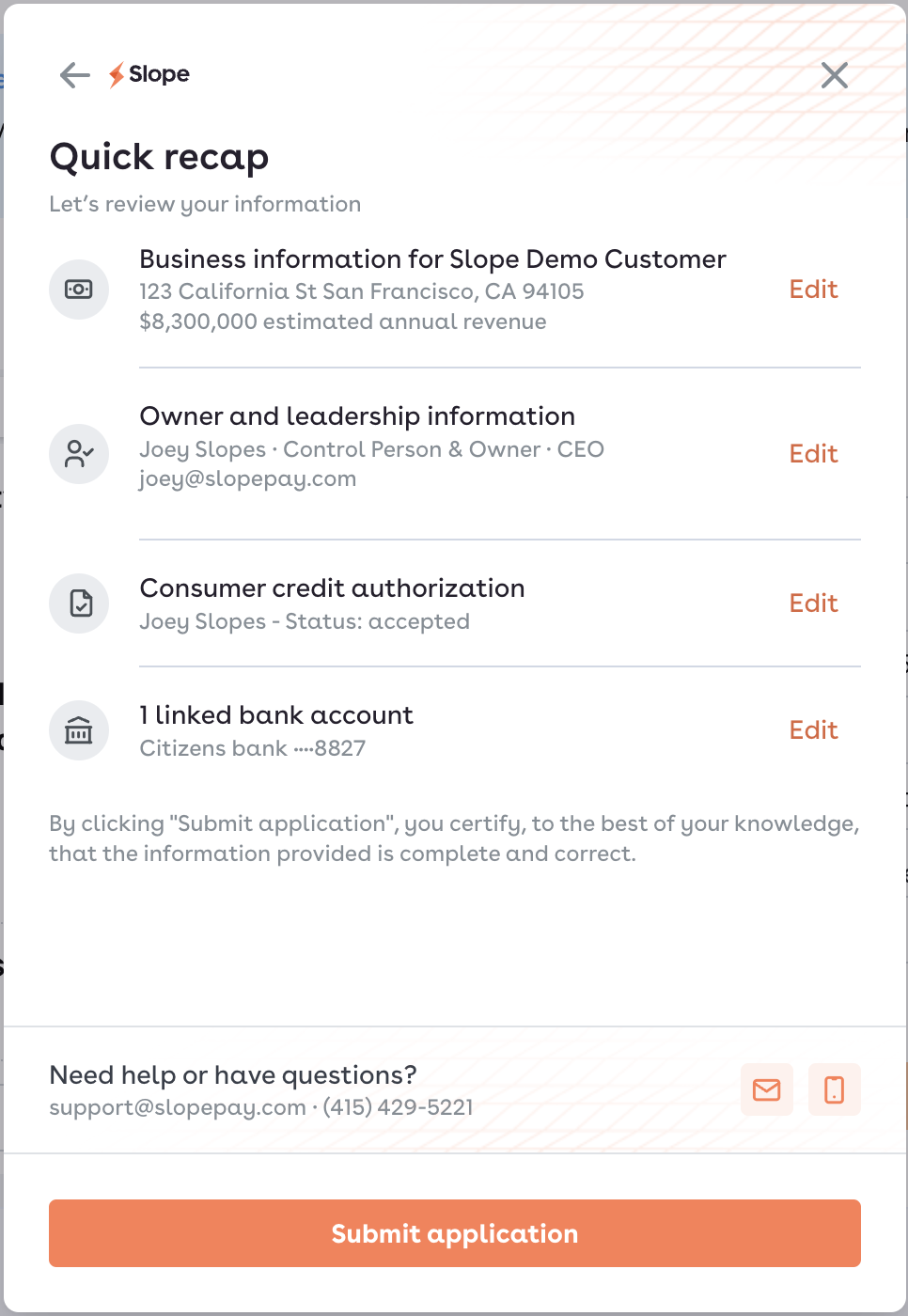

Last, review your application and click submit.

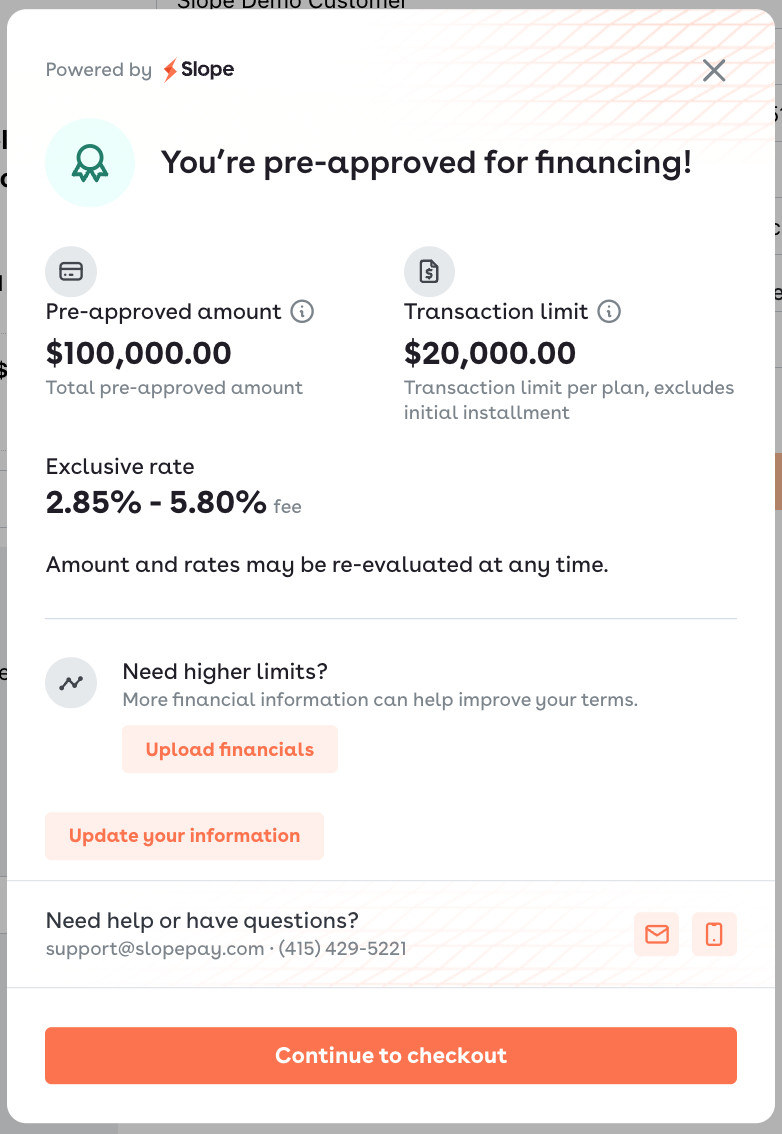

Voila! You'll be notified in seconds whether you're approved: