Slope 101 for Customers

Slope: Your Fuel for Growth

Pained by import shipping delays or slow payment from large customers / insurers / governments? Interested in saving procurement costs and strengthening supply chain relationships? See how Slope could help in each of these here!

Slope Product Overview*

Slope provides a one-stop platform to seamlessly finance and pay bills as well as manage your loans. We have two main products: Pay Later (i.e., finance your bills), and Pay Now (i.e., pay them instantly).

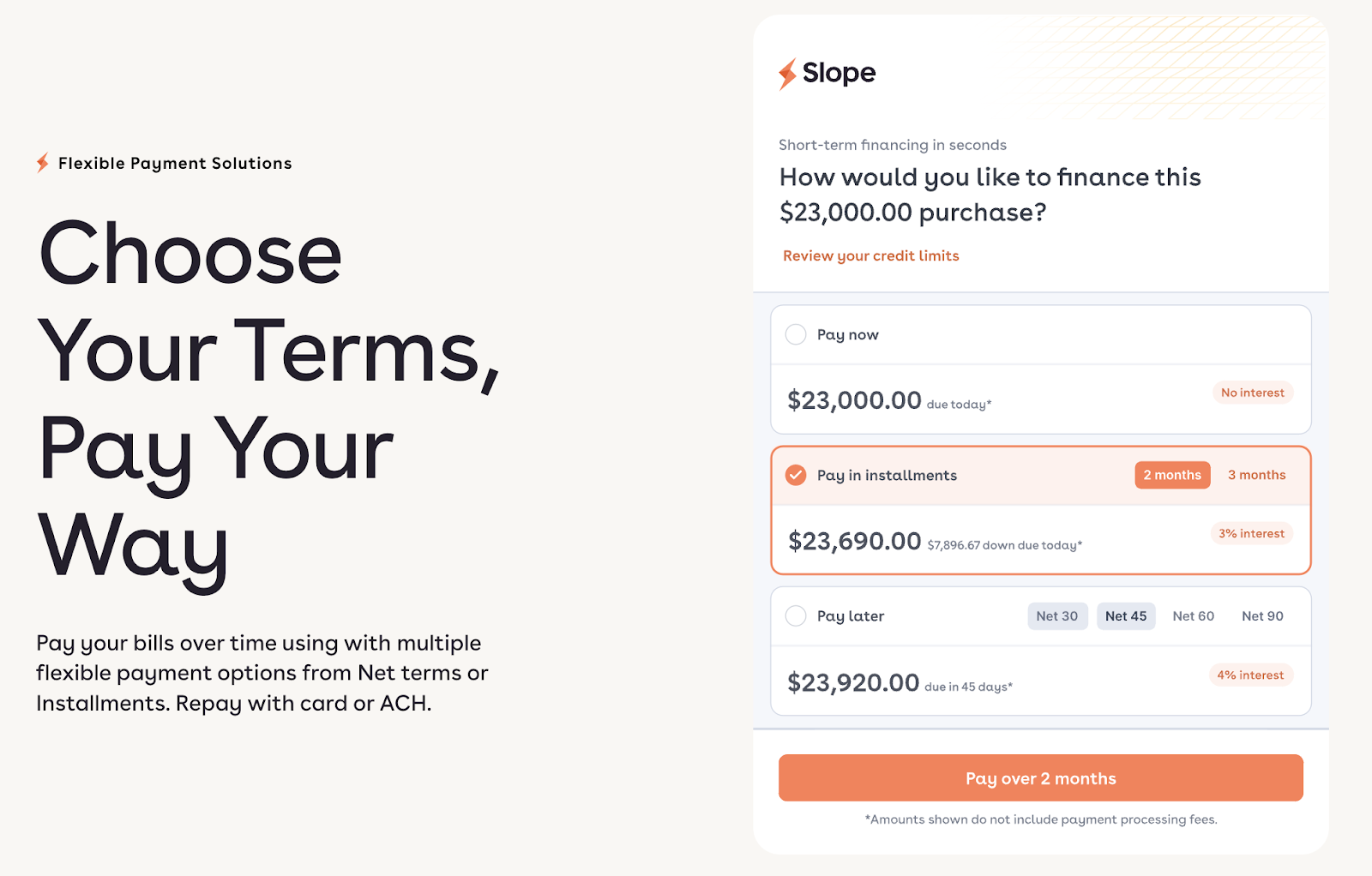

Pay Later

Scope: We help finance (on an unsecured basis) revenue-generating invoices, such as inventory purchases and marketing spend

Flexible Terms: Net terms up to 90 days, plus monthly installments up to 120 days**

Early repayment? We will prorate your fees! You get charged only for actual days borrowed.

Competitive Rates: This program offers risk-based pricing, with financing fees as low as 0.99% on Net 30 and 2.99% on Net 90 (equivalent to below 12% APR) for our best customers

No Hidden Charges: Our cost of borrowing is straightforward - no extra fees for applying or maintaining your financing limit; only “What You See Is What You Get”

Dynamic Line Size: Financing limits typically range from ~15% to approximately a third of your monthly revenue after debt service, depending on your credit profile

Once you’re approved, we reassess your business for line increases from time to time, as you accumulate payment history and expand

How It Works:

Each time you initiate a new Pay Later order, you choose a loan term and confirm the pricing. The entire process could be completed in seconds

Upon a quick check, we will pay your vendor on your behalf within one business day

You pay us back loan principal and financing fees either at the end of your net terms, or in monthly installments, based on the term option you chose

Multiple Payment Methods: You can repay with either ACH, debit card, or credit card

You get points/cashback and an extra 30-60 days’ float by repaying with a credit card, which can be well worth the 3.05% credit card processing fees we charge

Psssst - we accept most major cards, including AmEx!

Pay Now

You can also use our simple platform to immediately pay your vendors both domestic and abroad with either credit card or ACH, without a loan.

Application Process

Step 1 - Connect: If you’re interested, the Slope representative you’re in touch with will connect you with the Slope Customer Success (CS) team about an online application.

Step 2 - Apply online: Slope CS will guide you through how; the process takes about 5 minutes if you have the needed information.

Step 3 - Initial Approval: Upon completion, you could be approved for up to $250K without requiring further action on your end, or we might be in touch with any clarifying question(s) / information needed.

Step 4 - Higher Limit Approval (Where Applicable): After initial approval for up to $250K, if we see room for an even higher limit, we’ll reach out for additional information that would allow us to assess.

We look forward to helping your business grow!

Your Slope Team

*Slope is not a bank. Business-purpose loans are made by Lead Bank and subject to credit approval. Application is required and personal guaranty may be required depending on revenue. Subject to minimum revenue and business requirements. Fees vary based on loan amount.

**Net 90 and 120 installment terms are available to select approved customers subject to credit assessment.